Facts of violations of consumers’ rights in banking services are determined on the following grounds

Based on appeals from individuals and representatives of legal entities (oral, written, or electronic).

Based on the results of inspections conducted by the supervisory authorities of the Republic of Uzbekistan, the Consumer Rights Protection Service of the Head Office, as well as by working groups and special commissions.

Based on facts identified by the heads and responsible employees of structural divisions and branches of the Head Office.

Based on materials published and discussed in mass media and social networks.

If you believe that your rights have been violated, you may contact us through the communication channels listed below.

When facts of violations of consumer rights are identified, measures are taken to restore the violated rights, provide consumers with legal consultations, and apply appropriate disciplinary actions to employees responsible for the violations.

If the consumer is not satisfied with the measures taken by the Bank to restore their violated rights, or remains dissatisfied with the Bank’s activities, they have the right to appeal to the authorized state bodies, the court, or the Central Bank of the Republic of Uzbekistan.

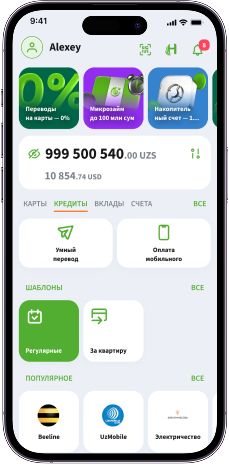

Methods and addresses for contacting JSCMB “Ipoteka-bank”

1. Reception days of the Bank’s management;

2. Contact Center of JSCMB “Ipoteka-bank”: (78) 150-11-22, 1233;

3. E-mail: info@ipotekabank.uz

4. Addresses of the Head Office and branches;

5. Virtual Reception of the President of the Republic of Uzbekistan: pm.gov.uz)

6. Law of the Republic of Uzbekistan “On Appeals of Individuals and Legal Entities”;

7.Law of the Republic of Uzbekistan “On Protection of Consumer Rights”;

8. “Regulation on the Minimum Requirements for the Activities of Commercial Banks in Interaction with Consumers of Banking Services”(registration No. 3030 dated 02.07.2018).

Dear clients!

Would you like to resolve disputes and issues with the Bank in a pre-trial manner?

Then take advantage of negotiation and mediation opportunities!

Within the system of JSCMB “Ipoteka-bank”, methods of negotiation and mediation are widely used for the pre-trial settlement of disputes.

In a legal society, the creation of alternative dispute resolution mechanisms is considered an effective means of restoring the violated rights of individuals and legal entities.

In this regard, systematic work is currently being carried out within the system of JSCMB “Ipoteka-bank” to improve the interaction of responsible employees with the public, ensure reliable protection of the rights and freedoms of clients and citizens, and introduce modern mechanisms for resolving their issues.

If you have any issues, disputes, or disagreements related to the activities of JSCMB “Ipoteka-bank,” you may contact the Bank’s Head Office in electronic or written form, as well as verbally by phone: (78) 150-11-22 or 1233.

When reviewing appeals, the Bank’s management ensures equality of rights of all parties, objectivity, legality, collegiality, and consistency in law enforcement practice, while respecting the rights and legitimate interests of applicants and adhering to the principle that all unavoidable contradictions and uncertainties in the legislation governing the procedure for reviewing appeals of individuals and legal entities are interpreted in favor of the applicant.

In addition, in accordance with the Economic Procedural Code and the Civil Procedural Code of the Republic of Uzbekistan, when preparing a case for trial, the judge determines whether the parties are able to reach a settlement agreement or use alternative methods of dispute resolution and explains to them the legal consequences of such actions.

Procedure for Releasing Collateral Assets or Substituting Collateral Items (Excerpt from the CMR)

Procedure for Releasing Collateral Assets or Substituting Collateral Items (Excerpt from the CMR) Aktivlarning shartlarini qayta ko'rib chiqish (Restrukturizatsiya) Tartibi

Aktivlarning shartlarini qayta ko'rib chiqish (Restrukturizatsiya) Tartibi