Avoiding debt is not about refusing credit altogether — it is about paying close attention to the terms and conditions. When borrowed funds are truly necessary, it is important to approach the decision consciously and without haste.

Sometimes a loan is genuinely unavoidable. In such cases, it is essential to make a responsible and balanced choice, carefully review the terms, and realistically assess your financial capacity.

Here is what you should consider to avoid common mistakes.

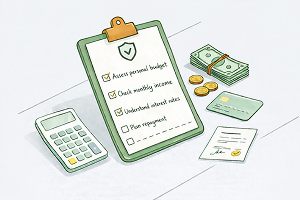

Conscious Preparation

A good loan begins long before visiting a bank.

The first step is defining a clear purpose. Not “just in case” and not “because it is being offered,” but a specific goal. It could be a purchase, renovation, business development, or education. The clearer the purpose, the easier it is to determine the appropriate payment amount and loan term.

The second step is an honest assessment of your financial capacity. A comfortable monthly payment typically amounts to around 30–40% of your monthly income. A higher financial burden can put pressure on your budget and reduce financial stability.

The third step is building a financial safety cushion. Ideally, you should have savings equivalent to three months of income. This provides reasonable protection in case of illness, delayed salary payments, or other unforeseen circumstances.

Finally, review your credit history. Recall past loans and installment plans — sometimes forgotten obligations or inaccuracies surface. Even minor delays or old debts may affect loan terms. It is better to address these issues in advance.

A Balanced Loan Choice

A common mistake among borrowers is accepting the first offer they receive.

Compare conditions in at least five or six banks. The interest rate is important, but it is not the only indicator. The total cost of the loan is far more revealing, as it reflects the actual overpayment including all associated charges.

Pay attention to the loan term. A shorter term means lower overall interest, but higher monthly payments. A longer term makes monthly payments more manageable, but increases the total repayment amount. The key is to find a reasonable balance.

Special attention should be given to fees, penalties, and additional services. Sometimes these are hidden in the fine print of the agreement. Do not hesitate to ask questions and clarify all terms.

It is also worth considering insurance in advance. It provides additional protection in difficult circumstances.

Careful Documentation

The loan agreement is the borrower’s primary document.

Read it in full, even if it seems lengthy. Clarify whether the interest rate can change and under what conditions. Do not hesitate to request explanations of unclear clauses. Check the right to early repayment and confirm there are no penalties for it.

Remember that you have time to review the agreement. There is no obligation to sign it immediately. A calm decision is almost always better than a rushed one.

Responsible Repayment

Once the loan is issued, it is important to manage repayments properly.

Follow the payment schedule. Even minor delays can negatively affect your credit history and create unnecessary stress. Automatic payments and reminders in the bank’s mobile application can help you stay on track.

If possible, use early repayment options. In many cases, it is more beneficial to shorten the loan term rather than reduce the monthly payment. This allows the principal to decrease faster, and interest is calculated on a smaller amount, ultimately reducing total overpayment.

Even the boldest individuals think twice when it comes to loans. That is why Ipoteka bank OTP Group launched a responsible lending campaign — to remind customers that financial decisions should be made thoughtfully.

Previously, we shared what to consider before taking out a loan.