What to consider before taking out a loan

A loan in itself is not a problem. Borrowed money can help solve an issue here and now, but it can also create an additional financial burden in the future. Difficulties arise when a loan is taken without proper calculation and a clear understanding of the consequences.

Let’s look at what you should consider before taking out a loan.

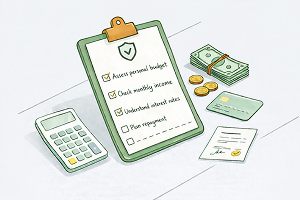

The first step is an honest assessment of your budget. Calculate all stable sources of income and mandatory expenses: rent, utilities, food, transportation, communication services, app subscriptions, and other regular costs. Only after that can you understand how much money remains available each month.

Experts recommend that total monthly payments on all loans should not exceed 30–40% of stable income. If the burden is higher, any unexpected situation can quickly undermine financial stability. A delayed salary, illness, or urgent repairs can immediately turn into a serious problem.

If you already have loans, be sure to take them into account when making a new decision. Write down all existing obligations, their terms, and interest rates. Sometimes it is wiser to postpone a new loan and first bring existing debts under control. In some cases, refinancing may help, but its terms also need to be carefully calculated.

One common mistake is focusing only on the monthly payment. It may seem affordable, but it can hide a long repayment period and a significant overpayment. Always look at the total cost of the loan and the full amount you will repay to the bank. The difference can sometimes be unexpectedly large.

A loan is not meant to compensate for a permanent lack of money. If your income is insufficient to cover basic expenses, borrowing will only postpone the problem and make it more expensive. In such cases, it is more effective to review your budget, income sources, and priorities first.

It is also important to have a financial safety cushion. Ideally, your reserve should equal about three months of income. This provides reasonable protection in case of salary delays or other unforeseen circumstances.

And most importantly, if your calculations leave you feeling anxious or as though you are taking on too much, it is worth listening to that signal. A loan can always be taken later, but the consequences of an ill-considered decision can last for years.

Before taking out a loan, it is important to think ahead about the consequences, realistically assess your capabilities, and only then make a decision.

Borrowed money requires calm calculation and an honest conversation with yourself. We want financial decisions to help people move forward, not create additional pressure. That is why Ipoteka bank OTP Group has launched a responsible lending campaign, emphasizing that loans should be approached consciously.

It is important to us that a loan is a clear and affordable solution that reflects real financial capacity — because even the bold think twice.