Super DongFeng Auto Loan

Apply directly at an official dealership - flexible down payment, and on-the-spot approval.

Apply in 5 minutes

Easy approval

Approved at the dealership in just a few minutes

Flexible terms

Annual rate from 0%, down payment from 25%

Fast decision

Up to 480M UZS financing - for DongFeng vehicles

Calculate the rate

www.ipotekabank.uz

Phone:(78) 150-11-22,

Contact center:1233

Section 1. Credit Information

Section 2. Important conditions related to other financial obligations

You have the right to receive complete and detailed information from the bank about the terms and amount of the loan, about the procedure for payment and settlement (interest, fines and penalties), about Your rights and obligations under the loan agreement, about the loan agreement about possible risks and responsibilities, as well as other issues that are unclear to you.

If you have complaints, you can send your appeal to (indicate the phone number) the digital phone number or (indicate the bank's postal address) the address or (indicate the bank's email address) the email address.

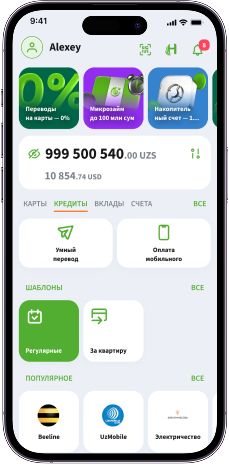

Fill out the application — and we will find the best solution for you.

A car loan created for you

Clear terms

Annual rate 0–22,0%

Fast and beneficial

Confirmed income is all you need

Co-borrower - optional

Need more funds? Add a co-borrower

No unnecessary bureaucracy

Passport and income proof - that’s all you need

Flexible payments

Submit your application via mobile app or on the website