Affordable BYD Auto Loan

(Rate from 11.9%)

Apply directly at an official BYD dealership - transparent terms, minimal paperwork, and on-the-spot approval.

Apply in 5 minutes

Easy approval

Approved at the dealership in just a few minutes

Flexible terms

Annual rate from 11,9%, down payment from 25%

Fast decision

Up to 480M UZS financing - for BYD vehicles

Calculate the rate

*The down payment may be lower (but not less than 20%) in case the share of car loans with a down payment parameter of lower than 25% in the total car loan portfolio issued after July 1, 2024 is below 15%

www.ipotekabank.uz

Phone:(78) 150-11-22,

Contact center:1233

Section 1. Credit Information

Section 2. Important conditions related to other financial obligations

You have the right to receive complete and detailed information from the bank about the terms and amount of the loan, about the procedure for payment and settlement (interest, fines and penalties), about Your rights and obligations under the loan agreement, about the loan agreement about possible risks and responsibilities, as well as other issues that are unclear to you.

If you have complaints, you can send your appeal to (indicate the phone number) the digital phone number or (indicate the bank's postal address) the address or (indicate the bank's email address) the email address.

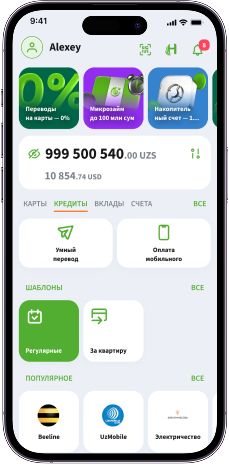

Fill out the application — and we will find the best solution for you.

A car loan created for you

Tushunarli shartlar

Yillik stavka 11,9–21,9%

Tez va foydali

Daromadingiz tasdiqlansa kifoya

Hamkredit oluvchi - ixtiyoriy

Yetarli mablag‘ yo‘qmi? Qo‘shma ariza topshiring

Ortiqcha byurokratiyasiz

Pasport va daromad hujjati kifoya

To‘lovlarni o‘zingizga qulay tarzda amalga oshiring

Mobil ilova yoki veb-sayt orqali ariza topshiring