Fixed-Term Deposit “DaroMax”

A reliable way to grow your savings with monthly income, flexible top-ups, and the ability to withdraw funds without losing interest

Apply

21,0%

Interest rate

24 months

Deposit term

500,000 UZS

Minimum amount

Calculate the rate

Fill out the application — and we will find the best solution for you.

- Term: 24 months

- Deposits opened in the mobile application (at maturity) — 21,0%

- Deposits opened in the mobile application (monthly payments) — 18,5%

- Deposits opened at bank branches (at maturity) — 20,5%

- Deposits opened at bank branches (monthly payments) — 18,0%

- Up to 1 month — 0%

- 1–3 months — 16,5% (at maturity), 150% (monthly)

- 3–6 months — 17,5% / 16.0%

- 6–12 months — 17,5% / 16,0%

- 12–24 months — 18,0% / 17,0%

- 24 months — 21,0% / 18,5%

- Up to 1 month — 0%

- 1–3 months — 16,0% / 14,5%

- 3–6 months — 17,0% / 15,5%

- 6–12 months — 17,0% / 15,5%

- 12–24 months — 17,5% / 16,5%

- 24 months — 20,5% / 18,0%

- Term — 24 months

- Amount over $40,000 (at maturity) — 4.00%

- Amount over $40,000 (monthly payments) — 3.60%

- Amount up to $40,000 (at maturity) — 3.80%

- Amount up to $40,000 (monthly payments) — 3.40%

- Up to 1 month — 0%

- 1–3 months — 1.50% / 1.10%

- 3–6 months — 2.00% / 1.60%

- 6–12 months — 2.50% / 2.10%

- 12–24 months — 3.00% / 2.60%

- 24 months — 4.00% / 3.60%

- Up to 1 month — 0%

- 1–3 months — 1.30% / 0.90%

- 3–6 months — 1.80% / 1.40%

- 6–12 months — 2.30% / 1.90%

- 12–24 months — 2.80% / 2.40%

- 24 months — 3.80% / 3.40%

- Term — 24 months

- Amount over €40,000 (at maturity) — 2.50%

- Amount over €40,000 (monthly payments) — 2.10%

- Amount up to €40,000 (at maturity) — 2.30%

- Amount up to €40,000 (monthly payments) — 1.90%

- Up to 1 month — 0%

- 1–3 months — 0.80% / 0.40%

- 3–6 months — 1.20% / 0.80%

- 6–12 months — 1.40% / 1.00%

- 12–24 months — 2.00% / 1.60%

- 24 months — 2.50% / 2.10%

- Up to 1 month — 0%

- 1–3 months — 0.60% / 0.20%

- 3–6 months — 1.00% / 0.60%

- 6–12 months — 1.20% / 0.80%

- 12–24 months — 1.80% / 1.40%

- 24 months — 2.30% / 1.90%

Partial — not available

Fixed-Term Deposit DaroMax

DaroMax is a replenishable fixed-term deposit with a 24-month term, available in UZS / USD / EUR, offering a choice of income payment options: monthly or a lump sum at maturity. The deposit can be opened via the mobile application or at bank branches.

Key Advantages

-

Flexible income format:

- regular interest payments monthly

- or interest payment at the end of the term

- Deposit replenishment — available during the first 3 months

- Early withdrawal (full) — available at any time during the deposit term. Previously paid interest is recalculated in accordance with early withdrawal conditions: the difference between paid and accrued interest is deducted from the principal amount.

- Deposit guarantee — deposits of individuals are guaranteed under the Law of the Republic of Uzbekistan “On Guarantees for the Protection of Citizens’ Deposits in Banks” up to 200 million UZS.

Main Terms

- Deposit term: 24 months

- Minimum amount: 500,000 UZS / 100 USD / 100 EUR

- Partial withdrawal: not available

- Interest capitalization: not applicable

- Interest calculation procedure: from the day following the crediting of funds until the day of deposit closure

Interest Rates (per annum)

National currency (UZS)

- Opened via mobile application: 21.0% (at maturity) / 18.5% (monthly)

- Opened at bank branches: 20.5% (at maturity) / 18.0% (monthly)

US Dollars (USD)

- Up to $40,000: 3.8% / 3.4%

- Over $40,000: 4.0% / 3.6%

Euros (EUR)

- Up to €40,000: 2.3% / 1.9%

- Over €40,000: 2.5% / 2.1%

Rate format: at maturity / monthly.

Early Withdrawal Rates

The rates below apply in case of early withdrawal depending on the actual placement period and the selected interest payment option (at maturity or monthly).

UZS — Early withdrawal (deposit opened via mobile application)

| Term, months | up to 1 | 1–3 | 3–6 | 6–12 | 12–24 | 24 |

|---|---|---|---|---|---|---|

| % at maturity | 0% | 16.5% | 17.5% | 17.5% | 18.5% | 21.0% |

| % monthly | 0% | 15.0% | 16.0% | 16.0% | 17.0% | 18.5% |

UZS — Early withdrawal (deposit opened at bank branches)

| Term, months | up to 1 | 1–3 | 3–6 | 6–12 | 12–24 | 24 |

|---|---|---|---|---|---|---|

| % at maturity | 0% | 16.0% | 17.0% | 17.0% | 17.5% | 20.5% |

| % monthly | 0% | 14.5% | 15.5% | 15.5% | 16.5% | 18.0% |

Note: the first value of each term interval includes the full number of months plus one day, while the second value includes the full number of months. The terms “up to 1” and “24” months include full calendar months.

USD — Early withdrawal (amount over $40,000)

| Term, months | up to 1 | 1–3 | 3–6 | 6–12 | 12–24 | 24 |

|---|---|---|---|---|---|---|

| % at maturity | 0% | 1.50% | 2.00% | 2.50% | 3.00% | 4.00% |

| % monthly | 0% | 1.10% | 1.60% | 2.10% | 2.60% | 3.60% |

USD — Early withdrawal (amount up to $40,000)

| Term, months | up to 1 | 1–3 | 3–6 | 6–12 | 12–24 | 24 |

|---|---|---|---|---|---|---|

| % at maturity | 0% | 1.30% | 1.80% | 2.30% | 2.80% | 3.80% |

| % monthly | 0% | 0.90% | 1.40% | 1.90% | 2.40% | 3.40% |

Same term calculation rules apply.

EUR — Early withdrawal (amount over €40,000)

| Term, months | up to 1 | 1–3 | 3–6 | 6–12 | 12–24 | 24 |

|---|---|---|---|---|---|---|

| % at maturity | 0% | 0.80% | 1.20% | 1.40% | 2.00% | 2.50% |

| % monthly | 0% | 0.40% | 0.80% | 1.00% | 1.60% | 2.10% |

EUR — Early withdrawal (amount up to €40,000)

| Term, months | up to 1 | 1–3 | 3–6 | 6–12 | 12–24 | 24 |

|---|---|---|---|---|---|---|

| % at maturity | 0% | 0.60% | 1.00% | 1.20% | 1.80% | 2.30% |

| % monthly | 0% | 0.20% | 0.60% | 0.80% | 1.40% | 1.90% |

Note: the first value of each term interval includes full months plus one day, the second value includes full months only. “Up to 1” and “24” month terms are calculated based on full months.

Deposit Repayment Is Guaranteed

The Fund for Guaranteeing Citizens' Deposits in Banks of the Republic of Uzbekistan ensures the stability of the banking system, and also serves as a guarantee for the return of up to 200 million soums in deposits of the population. In the event of an insured case, deposits are repaid according to the following deadlines:- From January 1, 2026 — within 15 working days;

- From January 1, 2027 — within 7 working days.

On approval of the regulation on minimum requirements for the activities of commercial banks in the implementation of relations with consumers of banking services

Appendix № 3

INFORMATION SHEET ON THE MAIN CONDITIONS OF DEPOSITS*

|

Name of the commercial bank, official website, phone numbers |

JSCMB «Ipoteka-bank», www.ipotekabank.uz |

|

Phone: Contact-center (78) 150-11-22, 1233 |

Section 1. The main conditions of the deposit

|

1. Deposit name |

Term deposit “DaroMax”. |

|||

|

2. The currency of deposit |

In national currency (UZS), in foreign currency (US dollars and EURO) |

|||

|

3. Registration type |

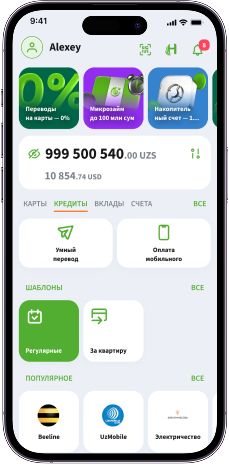

Ipoteka-Retail |

At bank’s branches |

||

|

4. Interest payment |

At maturity |

Monthly |

At maturity |

Monthly |

|

5. The annual interest rate on the deposit in the national currency |

21,0% |

18,5% |

20,5% |

18,0% |

|

6. Registration type |

At bank’s branches |

|||

|

7. Amount |

above $40 000 |

up to $40 000 |

||

|

8. Interest payment |

At maturity |

Monthly |

At maturity |

Monthly |

|

9. The annual interest rate on the deposit in foreign currency US dollars |

4,0% |

3,6% |

3,8% |

3,4% |

|

10. Registration type |

At bank’s branches |

|||

|

11. Amount |

above €40 000 |

up to €40 000 |

||

|

12. Interest payment |

At maturity |

Monthly |

At maturity |

Monthly |

|

13. The annual interest rate on the deposit in foreign currency EURO |

2,5% |

2,1% |

2,3% |

1,9% |

|

14. Capitalization of interest on the deposit (recalculation of interest by adding accrued interest to the principal amount) |

Without capitalization |

|||

|

15. Deposit term |

24 months |

|||

|

16. Minimum deposit amount (if applicable) |

500,000 (five hundred thousand) uzs, 100 US dollars (one hundred), 100 EUROS (one hundred) |

|||

|

16. Frequency of payment of interest on the deposit |

1. When opening a deposit with a monthly interest payment, funds are transferred once a month. |

|||

|

17. Procedure for opening a deposit (online or by visiting a bank) |

The deposit can be opened via the Ipoteka-Retail mobile application or at the bank's branches, in both cash and non-cash forms. |

|||

|

18. The possibility of depositing additional funds |

Available only for the first 3 months (interest is accrued on additional funds deposited from the next day on the total balance of funds). |

|||

|

19. Auto-prolongation (unilateral extension of the deposit period by the bank at the end of the deposit period) |

Not available |

|||

|

20. Other conditions |

Interest is accrued from the day after the funds are received and the day before the deposit is closed. |

|||

Section 2. Other important conditions

|

1. The possibility of partial withdrawal of deposited funds before the end of the deposit period |

Not available |

|

|||||

|

2. Registration type |

Ipoteka-Retail |

At bank’s branches |

|

||||

|

3. The procedure for early termination of the deposit agreement in national currencies |

Period |

At maturity |

Monthly |

At maturity |

Monthly |

|

|

|

up to 1 month |

0,0% |

0,0% |

0,0% |

0,0% |

|

||

|

from 1 to 3 months |

16,5% |

15,0% |

16,0% |

14,5% |

|

||

|

from 3 to 6 months |

17,5% |

16,0% |

17,0% |

15,5% |

|

||

|

from 6 to 9 months |

17,5% |

16,0% |

17,0% |

15,5% |

|

||

|

from 9 to 12 months |

17,5% |

16,0% |

17,0% |

15,5% |

|

||

|

from 12 to 18 months |

18,0% |

17,0% |

17,5% |

16,5% |

|

||

|

from 18 to 24 months |

18,0% |

17,0% |

17,5% |

16,5% |

|

||

|

4. Registration type |

At bank’s branches |

|

|||||

|

5. Amount |

above $40 000 |

up to $40 000 |

|

||||

|

6. The procedure for early termination of the deposit agreement in foreign currency USD |

Period |

At maturity |

Monthly |

At maturity |

Monthly |

|

|

|

up to 1 month |

0,0% |

0,0% |

0,0% |

0,0% |

|

||

|

from 1 to 3 months |

1,5% |

1,1% |

1,3% |

0,9% |

|

||

|

from 3 to 6 months |

2,0% |

1,6% |

1,8% |

1,4% |

|

||

|

from 6 to 9 months |

2,5% |

2,1% |

2,3% |

1,9% |

|

||

|

from 9 to 12 months |

2,5% |

2,1% |

2,3% |

1,9% |

|

||

|

from 12 to 18 months |

3,0% |

2,6% |

2,8% |

2,4% |

|

||

|

from 18 to 24 months |

3,0% |

2,6% |

2,8% |

2,4% |

|

||

|

7. Registration type |

At bank’s branches |

|

|||||

|

8. Amount |

above €40 000 |

up to €40 000 |

|

||||

|

9. The procedure for early termination of the deposit agreement in foreign currency EURO |

Period |

At maturity |

Monthly |

At maturity |

Monthly |

|

|

|

up to 1 month |

0% |

0% |

0% |

0% |

|

||

|

from 1 to 3 months |

0,8% |

0,4% |

0,6% |

0,2% |

|

||

|

from 3 to 6 months |

1,2% |

0,8% |

1,0% |

0,6% |

|

||

|

from 6 to 9 months |

1,4% |

1,0% |

1,2% |

0,8% |

|

||

|

from 9 to 12 months |

1,4% |

1,0% |

1,2% |

0,8% |

|

||

|

from 12 to 18 months |

2,0% |

1,6% |

1,8% |

1,4% |

|

||

|

from 18 to 24 months |

2,0% |

1,6% |

1,8% |

1,4% |

|

||

|

10. Citizens' deposits are guaranteed by the Law of the Republic of Uzbekistan "On guarantees for the protection of citizens' deposits in banks" up to 200 million UZS. |

|

||||||

Please review the information sheet before agreeing to open a deposit!

You have the right to receive full and detailed information from the bank about the terms of the deposit, the interest income on the deposit and the settlement procedure, as well as about your rights and obligations and other issues that are unclear to you.

In case of claims, you can send your request by phone +998 (78) 150-11-22 or to the address Tashkent, Shakhrisabz str., 30 or by e-mail info@ipotekabank.uz.

THE CORRECTNESS AND AUTHENTICITY OF THE INFORMATION SHEET IS CONFIRMED.

(Full name and position of bank’s employee) (Date of filling in)

The information sheet does not replace a deposit agreement or a deposit acceptance order, on the contrary, it helps to compare the deposit conditions of different banks and make the right choice