Savings Account

Deposit and withdraw anytime — your savings are protected up to UZS 200 million

Apply

16%

Interest rate

Unlimited

Deposit term

15 mln so‘m

Minimum amount

Calculate the rate

Fill out the application — and we will find the best solution for you.

Earn 16% annual interest — and keep full access to your money anytime.

Want your savings to grow every day — without locking them away? The Savings Account from Ipoteka Bank OTP Group combines stable income with complete flexibility. Deposit, withdraw, or close your account anytime — without losing your accrued interest.

Key Terms

- Interest rate: 16% per annum — fixed for accounts opened via the mobile app or at any branch

- Term: Open-ended — funds stay active as long as you wish

- Minimum amount: from UZS 15,000,000

- Top-up: no limits on amount or timing

- Interest payments: credited monthly to your account or e-wallet

Why it’s a smart choice

- Flexible access: withdraw part or all of your funds anytime without losing interest

- Reliable income: fixed 16% annual rate for predictable growth

- Daily accrual: your balance starts earning from day one

- Guaranteed safety: deposits insured by law up to UZS 200 million

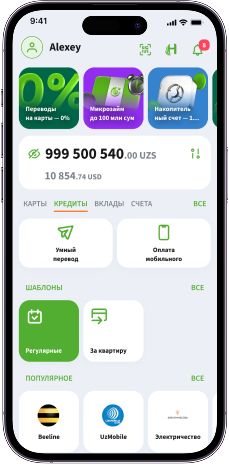

- Easy control: manage your account in the Ipoteka Retail app or at any branch

How to open

- Install the Ipoteka Retail mobile app or visit a nearby branch.

- Select “Savings Account.”

- Deposit from UZS 15,000,000.

- Start earning automatically — interest is accrued daily.

Make your money work for you — safely, steadily, and on your terms.

Return on deposits guaranteed

The Fund for Guaranteeing Citizens' Deposits in Banks of the Republic of Uzbekistan ensures the stability of the banking system, and also serves as a guarantee for the return of up to 200 million soums in deposits of the population. In the event of an insured case, deposits are repaid according to the following deadlines:- From January 1, 2026 — within 15 working days;

- From January 1, 2027 — within 7 working days.

On approval of the regulation on minimum requirements for the activities of commercial banks in the implementation of relations with consumers of banking services

Appendix № 3

INFORMATION SHEET ON THE MAIN CONDITIONS OF DEPOSITS*

Name of the commercial bank, official website, phone numbers | JSCMB «Ipoteka-bank», www.ipotekabank.uz Phone: Contact-center (78) 150-11-22, 1233 |

Section 1. The main conditions of the deposit

| The main terms and conditions of deposit | |

1 | Name of the product | Savings account |

2 | The object of registration | Funds are accepted through the Ipoteka-Retail mobile application and retail cash desks, in cash and non-cash form. |

3 | Date of receipt | From 18th of April 2025 |

4 | Term | Unlimited |

5 | Annual interest rate | 16% |

6 | Minimum amount | 15 000 000 UZS |

7 | The top up of funds | Available |

8 | The procedure for calculating the interest |

– Interest is accrued from the day after the funds are received and the day before the account is closed; |

9 | Interest payments | When registering through the mobile application, the monthly interest income is automatically transferred to the e-wallet account. When registering at retail cash desks, the monthly interest income is transferred to the client’s savings account. |

10 | Capitalization | Not available |

11 | Partial withdrawal | Available (considering that the minimum amount of the balance does not decrease below the minimum amount) |

12 | Registration procedure | The offer agreement and the bank's deposit agreement in e-form |

13 | A note to the client | In accordance with the bank's tariffs, starting from June 1, 2025, the interest rate on the Savings Account product will be reduced from 18% to 16% for all customers, including current ones.

Citizens' deposits in banks are guaranteed in accordance with the Law of the Republic of Uzbekistan "On guarantees for the protection of citizens' deposits in banks" |

Please review the information sheet before agreeing to open a deposit!

You have the right to receive full and detailed information from the bank about the terms of the deposit, the interest income on the deposit and the settlement procedure, as well as about your rights and obligations and other issues that are unclear to you.

In case of claims, you can send your request by phone +998 (78) 150-11-22 or to the address Tashkent, Shakhrisabz str., 30 or by e-mail info@ipotekabank.uz.

THE CORRECTNESS AND AUTHENTICITY OF THE INFORMATION SHEET IS CONFIRMED.

(Full name and position of bank’s employee) (Date of filling in)

The information sheet does not replace a deposit agreement or a deposit acceptance order, on the contrary, it helps to compare the deposit conditions of different banks and make the right choice