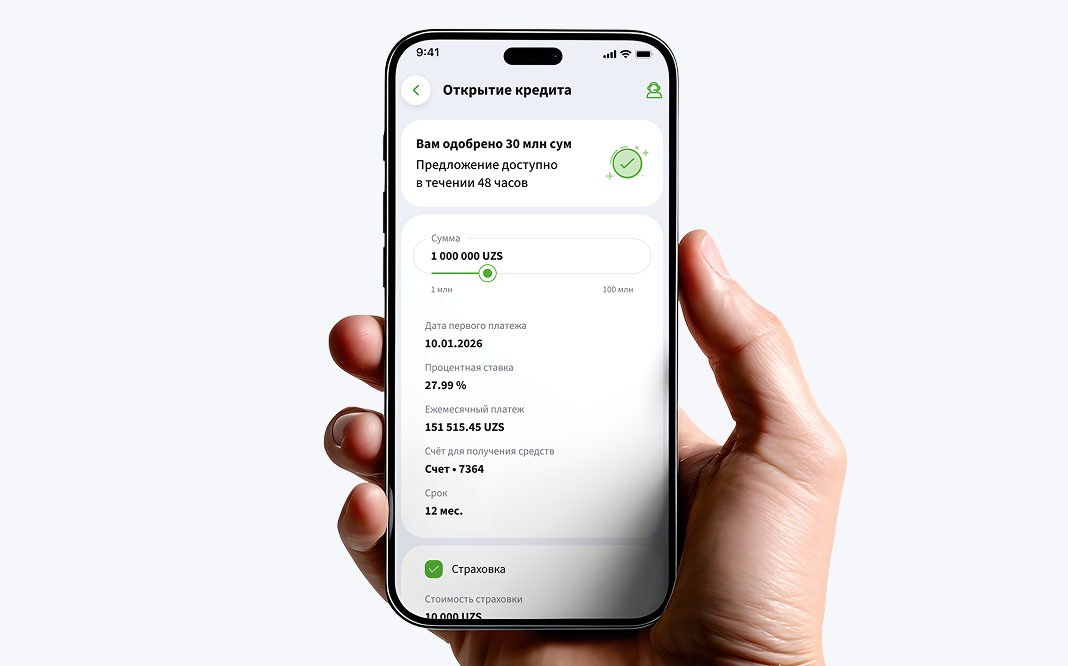

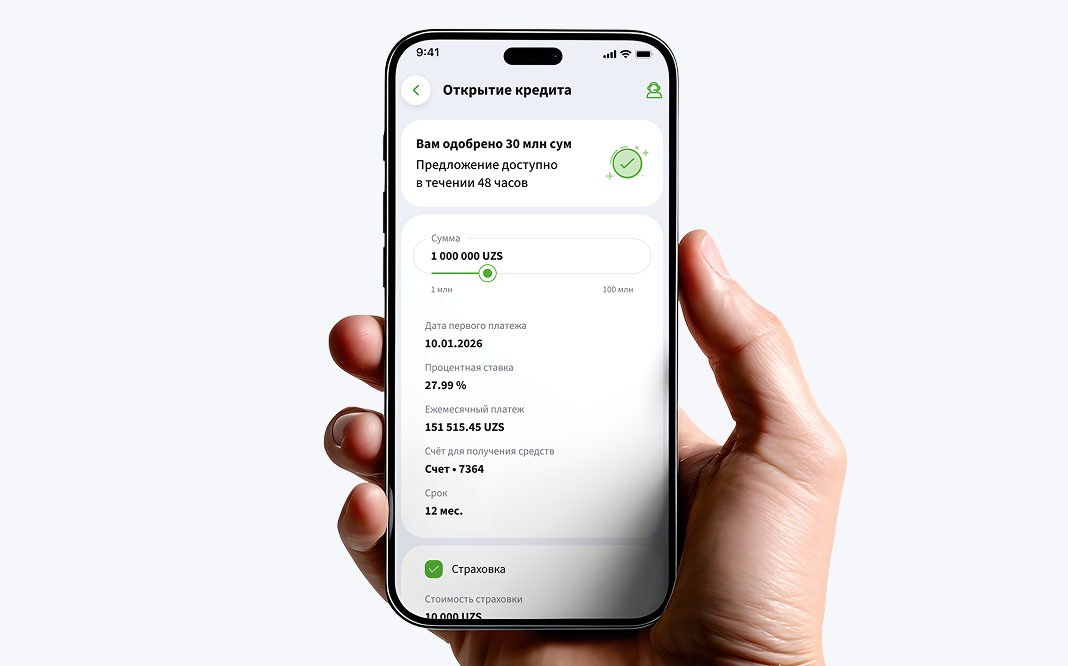

Microloan – up to 100,000,000 UZS

No collateral and no proof of income required.

You have the right to receive complete and detailed information from the bank about the terms and amount of the loan, about the procedure for payment and settlement (interest, fines and penalties), about Your rights and obligations under the loan agreement, about the loan agreement about possible risks and responsibilities, as well as other issues that are unclear to you.

If you have complaints, you can send your appeal to (indicate the phone number) the digital phone number or (indicate the bank's postal address) the address or (indicate the bank's email address) the email address.