- Identity document (passport of the Republic of Uzbekistan)

- Sale and purchase agreement

- Proof of down payment

- Documents confirming property readiness (cadastral documents and handover act)

- Proof of income for the past 6 months

- ESMS checklist (environmental and social questionnaire) — completed during the transaction

- Collateral — the purchased property (arranged during the transaction)

Fill out the form — and we’ll find the best solution for you

- From 21. By the date of the final payment — no older than 70.

- After age 63, a life-insurance policy is required (or a co-borrower with income) up to age 70 inclusive.

- Proven income for the last 6 months (for the borrower / co-borrowers).

- Minimum combined monthly income — at least 1,050,000 UZS per month.

- Maximum debt-to-income ratio (DTI) ≤ 50% (no more than 50% of income can go to loan payments).

- Passport / ID

- Sale and purchase agreement

- Down-payment confirmation

- Cadastral documents and acceptance/transfer act

- ESMS checklist

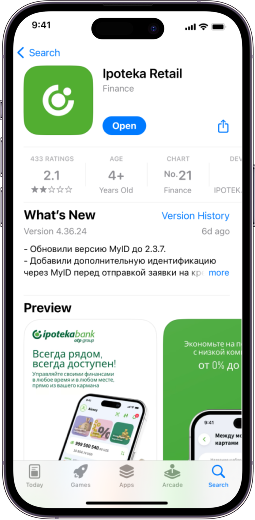

www.ipotekabank.uz

Phone:(78) 150-11-22,

Contact center:1233

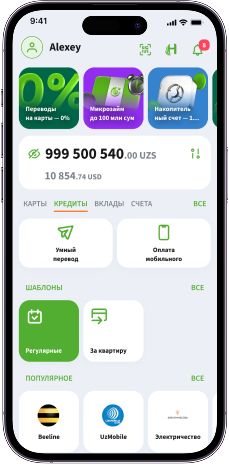

Section 1. Credit Information

You have the right to receive complete and detailed information from the bank about the terms and amount of the loan, about the procedure for payment and settlement (interest, fines and penalties), about Your rights and obligations under the loan agreement, about the loan agreement about possible risks and responsibilities, as well as other issues that are unclear to you.

If you have complaints, you can send your appeal to (indicate the phone number) the digital phone number or (indicate the bank's postal address) the address or (indicate the bank's email address) the email address.